Scammers Rife – Tips on how to identify & avoid them.

As we approach tax time, the number of scams relating to tax return processing and End of Financial Year (EOFY) matters will be increasing. It is estimated that 24% of Australians have already experienced one of these scams in 2023.

Typically, these scammers pretend to be from the Australian Tax Office (ATO) and use various methods to con people out of their money using email, phone calls, online methods and text messages.

Here are some of the most common methods used by fraudsters, with visual examples that are known to be circulating:

Phone Scams

Scammers call their victim, claiming to be from the ATO and demand that their tax debt needs to be paid right away, or else there will be severe penalties. While the ATO does use the phone to contact people, they will never:

- Send a pre-recorded message

- Threaten to arrest you

- Demand payments of gift-cards or payments to personal bank accounts

- Insist you remain on the phone until you make the payment.

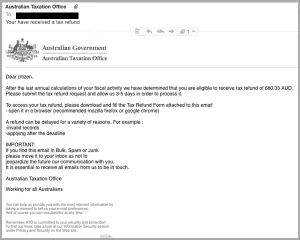

Email Scams

The victim receives an email that appears to be from the ATO. The email contains links which direct the viewer to a fake ATO website which then asks for personal information or bank details. There are also emails which tell people that their 2023 tax lodgment has been received. The recipient is then asked to open an attachment and sign a document after completing a ‘to do list’, which is their way of gaining your personal information.

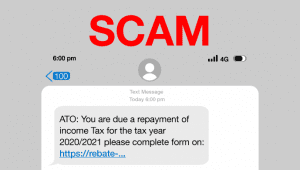

SMS Scams

Similar to the email scams, victims are sent an SMS which contains links that will take them to a fake ATO website. The website asks for personal identifying details including the recipients credit card information. The real ATO will never send an SMS with a link to log in to online services or ask for credit card details. Ever.

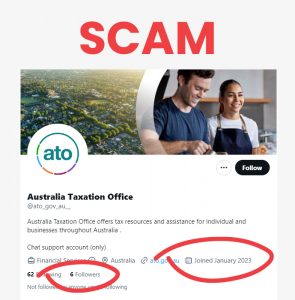

Social Media & Online Chat Scams

There are many fake ATO social media accounts which ask users to message them with their enquiry. From there, they say they require your personal information to assist you. Although the ATO do have official accounts for Facebook, Twitter and LinkedIn, they will never ask for your personal information via a social media channel. Make sure you check the number of ‘followers’ they have, when the joined the social media platform and their content.

Refund Scams

Scammers contact the victim to give them the good news that they are eligible for a tax refund. They then continue to ask for personal information to ensure that the refund goes into the correct bank account.

Protecting yourself from scams

Many Australians have been caught out by these scams. It is important that you remain cautious and ensure you do not become a victim by following these simple steps;

Don’t click on links

If you receive an email or SMS claiming to be from the ATO, do not click on any links. It’s best to assume the communication is dodgy and visit the myGov website or contact the ATO directly to discuss the communication.

Verify contact

Unlike scammers, the ATO will never contact you to tell you that you are going to prison or ask you to pay an amount by giving your credit card details. If someone suspicious does contact you, call the ATO to verify. Never take action – verify with the ATO directly.

Protect your personal information

Scammers can use your details such as name, tax file number or credit card details to steal thousands of dollars from you. Never provide this information to anyone unless you know the source.

Inform those around you

Let your friends and family know about these scams. There are many vulnerable people in the community who may not be tech-savvy and do now know how to look out for signs that these contact methods by the scammers are fake. Spread your knowledge!

Seek professional advice

Get in touch with your Accountant or the ATO to clear up anything that you are concerned about.

Report Scammers

If you think that you have been contacted by one of these scammers, it is important to report it to the ATO or Scamwatch so we all can work towards a reduction in the amount of scams in the community.

The ATO has further details on how to report a scam here.

You can also make a direct report on the Scamwatch website here.

PLEASE BE VIGILANT, OVERLY CAUTIOUS & MOST IMPORTANTLY… IF YOU HAVE EVEN THE SLIGHTEST DOUBT, DO NOT RESPOND & CONTACT THE ATO DIRECTLY!