Reminder for Employers – The Super Guarantee rate increases on 1 July 2023.

It’s important for employers to note that the Super Guarantee (SG) rate will increase from the current 10.5% to 11% on 1 July 2023.

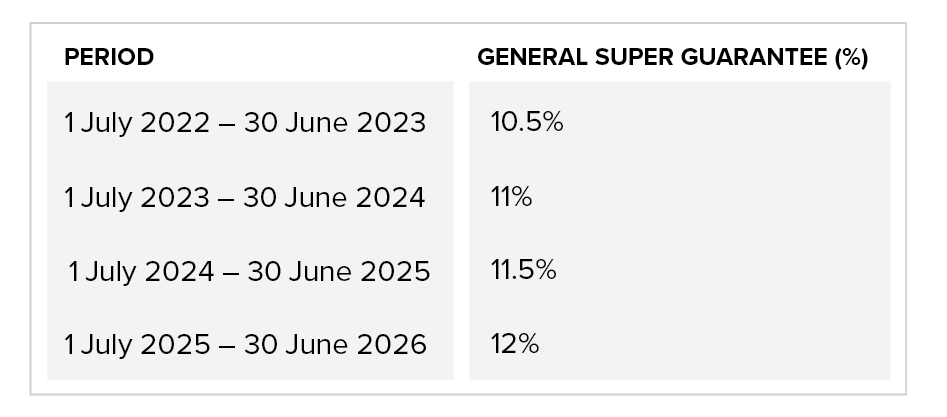

The Federal Budget announced in May 2023 maintained the SG’s legislated increases, meaning it will continue to increase by 0.5% on 1 July each year until it reaches 12% in 2025.

Employers must update their payroll system to comply with this upcoming increase, actioning the increase to employee payments made on or after 1 July 2023.

Here’s a quick snapshot of the SG percentage increases between now and 2026.

How might super payments be changing in the future?

Super to be paid with salary and wages to tackle unpaid super

From 1 July 2026, employers will be required to pay their employees’ super at the same time as their salary and wages. This change will help address the $5 billion a year scourge of unpaid super by making it easier for workers to keep track of payments and for the Australian Taxation Office (ATO) to monitor compliance. It will also reduce the risk of businesses building up large super contribution liabilities at the end of each quarter. This move will also lead to higher returns for more than 4 million Australians currently receiving their super quarterly, as super paid more frequently compounds faster.

More funding and resources for the ATO to tackle unpaid super

The Government also announced $40 million in funding for the ATO so it better enforces super compliance, plus it has announced stronger targets for the ATO’s recovery of unpaid super amounts. So, employers – if you’re not compliant, it’s only a matter of time until the ATO is knocking on your door…

Further Resources are available!

Further details and resources can be found on the ATO website here. The ATO also provides assistance for Australians to keep track of their Super here.

If you still have queries, as an employer or individual, chat with your Highview specialist – we’re here to help!

Source: www.ato.gov.au