LOGBOOKS BEING SCRUTINISED BY THE ATO – is your logbook actually valid!?

The ATO have increased their compliance measures & will be actively scrutinising logbook claims. To avoid your logbook being rejected, you must meet the ATO’s requirements.

The team at Highview are here to help simplify these logbook requirements, so you can feel clear & confident on your entitlements this tax time.

To break it down… you must have valid copy of your logbook, including your vehicle odometer reading recorded on 30th June 2023, to be able to claim the logbook method as a deduction for your vehicle expenses on your tax return.

To maximise your tax refund & claim the logbook method in your tax return, your Accountant will need to ensure your logbook details are valid & all substantiation documentation is accurate & on file. At Highview, we recommend our clients take a photo of their vehicle odometer reading on 30th June 2023 & provide this to us with their valid logbook & any other supporting documentation at tax time. Covering all bases!

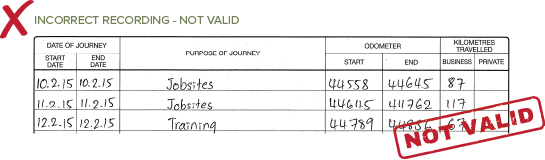

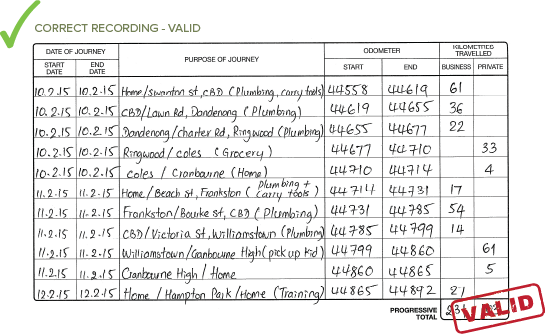

Refer to the below for valid logbook & general expense keeping examples:

Most recently the ATO’s audit focus on logbooks has been related to the following areas:

- Whether your vehicle trips are work related or personal

For example: If you are employed under the CFMEU EBA, travelling to & from your jobsite & home is private in nature. To claim this travel expense you must be carrying bulky tools & not have a lockable storage facility provided by your employer. Paragraph 25.9 of the EBA outlines that your employer must provide a suitable lockable storage facility & the ATO are rejecting logbook claims based on this.

- If your kilometres travelled in the logbook period are a true representation of your total annual kilometres travelled

For example: If your kilometers (work related & personal) travelled in your 13 week logbook period total 5,000kms, the ATO will expect that your annual km’s travelled are within a 10% variance of this figure. In this case, they will annualise the km’s from the logbook to 20,000kms, so if your annual odometer readings indicate that you travelled 25,000kms for the year, this is a 25% variance from what the logbook indicates & therefore the ATO would reject the logbook on the basis of it not being a true representation of your travel.

- Data matching of your logbook against 3rd party location information

For example: The ATO will use third-party documentation such as bank statements, toll statements, wages records & other third-party location information to ensure the locations you provide in your logbook align with these records. It is critical that your logbook locations are accurate.

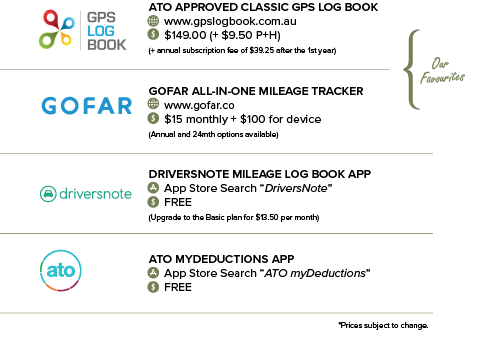

Did you know about Electronic Logbook Apps?

The ATO have approved electronic logbook apps that are user-friendly & reliable, below are some of the ones we recommend.

You can also use a handwritten logbook or an Excel spreadsheet. However, these may not be ATO compliant without sufficient detail, so it’s important to understand the valid logbook requirements.

For further information visit the ATO website here or speak with your Highview Accountant.

Source: www.ato.gov.au/