Should I cash the $10k from Super?

Highview’s Financial Planner Bruce Chisholm gives us his thoughts…

I’ve had a few calls asking whether they should cash the $10k from super pre 30 June and $10k after 1 July as they have been affected by working hours reduced by more than 20%, as a result of COVID-19.

If you are in a tight spot and really need the cash, after carefully considering your other options, you may feel it’s the best or only option for you.

But, it’s very important to consider some of the implications…

Firstly, it could affect the insurance you may have via your super fund, if your balance drops below $6,000. So be cautious and check this.

Secondly, what impact will it have on your retirement?

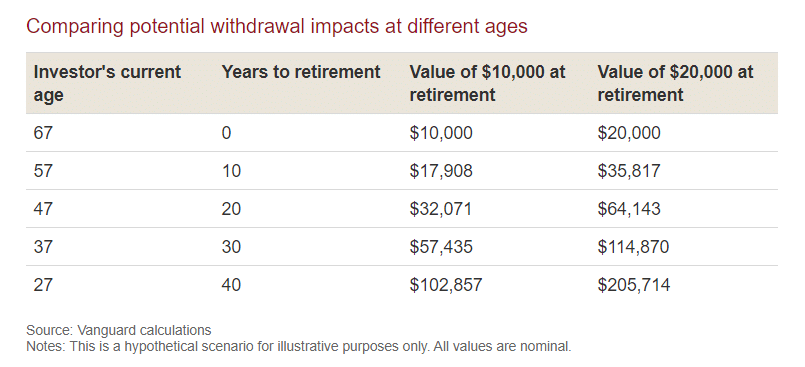

You will be crystallizing current losses in your super and missing out on some of the recovery. And, according to Albert Einstein, you will be missing out on the 8th wonder of the world – compound interest. Our friends at Vanguard have kindly crunched the numbers. It’s based on a balanced multi asset fund returning a net 6% annually.

If you are 27 and cash $20k, this effectively costs you over $200k at retirement – that’s a lot of smashed avo breakfasts ‘future retired you’ will miss out on!

If you’d like to speak with me about your specific circumstances, or are keen to book a Discovery Meeting please send me an email and we can discuss, bruce@highview.com.au

Stay safe.

Bruce Chisholm

Financial Planner

Authorised Representative No. 1235025 of InterPrac Financial Planning Pty Ltd Licence No. 246638 Highview Wealth Solutions Pty Ltd Trading as Highview Accounting & Financial

Bruce has written his article for general information purposes only and it does not constitute personal advice. This information has been prepared without considering any individual’s objectives, financial situation or needs. You should not act solely on the basis of material contained in this article. We recommend that formal advice is sought which considers all your individual objectives and needs.