Confirmed Tax Rate Changes from 1 July 2024.

There is finally a little bit of good news for middle income individuals with an announcement made by the Government in late January, and now confirmed, tax rate and threshold changes. These changes will come into effect on 1 July 2024.

Tax Cuts

The Government announced that all 13.6 million taxpayers across the country will receive a tax cut under Labor’s Better Tax Cuts Plan, however for many on higher incomes it will be a smaller tax cut than they were expecting. Although the plan delivers a permanent reduction in tax for all taxpayers, those earning between $50,000 and $135,000 will see the biggest benefit from the proposed changes.

The Changes

From 1 July 2024, the tax rate changes will include:

- Reduction of the 19% tax rate to 16% (for incomes between $18,200 and $45,000).

- Reduction of the 32.5% tax rate to 30% (for incomes between $45,000 and the new $135,000 threshold).

- Increase the threshold at which the 37% tax rate applies from $120,000 to $135,000.

- Increase the threshold at which the 45 % tax rate applies from $180,000 to $190,000.

The last tax plan was designed five years ago – prior to the pandemic, the global inflation spike and interest rate rises. With Australians doing it tough for the past few years with these global issues, it is sure to be a welcome change.

So, what does this mean for you?

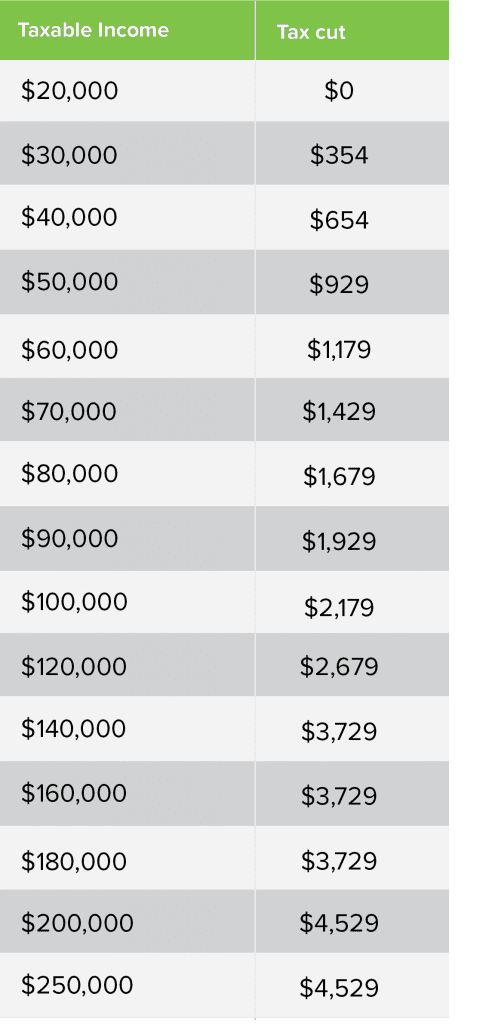

The below table demonstrates what you will save per annum on your tax based on your level of income.

For a more accurate estimate of your tax cut, you can use the tax cut calculator here:

https://treasury.gov.au/tax-cuts/calculator

Get in touch with your trusted and knowledgeable Highview Accountant to discuss your personal situation – contact us today!

Source: Australian Government – The Treasury, https://treasury.gov.au/