Gone are the days of ‘warnings’. The ATO mean business when it comes to superannuation obligations and on-time payment. Get informed or pay the price (literally!)

As an employer, looking after your superannuation obligations is of vital importance. We urge our clients to keep informed and proactive.

Ignorance or lack of due diligence can eventually come back to bite employers. So, our Partner of Mornington office, Sam Nixon, breaks down some of the important information to help you understand your obligations as an employer.

Employee Superannuation and other Payroll Entitlements

The implementation of Single Touch Payroll (STP) across Australian businesses has streamlined the ATO’s reporting and data matching systems. The advancements in technology flag quickly a range of behaviors that drive non-compliance, and the ATO are tailoring their interventions for the behaviors flagged, including late payment, underpayment, and non-payment of superannuation.

This isn’t an invasion of privacy – the goal is to protect employees and ensure their employers are complying with their payment obligations. If you’re doing the right thing by your employees, there is no need for concern.

With data matching systems, the ATO are now able to:

- contact employers who are not meeting their obligations earlier, with improved messaging;

- identify trends of incorrect reporting or issues related to information reported;

- take action to help employers and funds to get it right; and

- improve any systemic data quality issues.

Employers should expect to see more SG compliance measures over the coming years. Our Team at Highview are certainly noticing this trend.

So, what must employers do to ensure compliance? Read more here.

Pay on-time OR face the ATO’s Super Guarantee stringent penalties.

If an employee’s super is not paid in full, on time, or to the right super fund, the employer will need to prepare, lodge and pay the Super Guarantee Charge (SGC) which is made up of:

- the super owed (calculated on all salary and wages, which includes overtime)

- nominal interest on those amounts (currently 10%)

- an administration fee of $20 per employee, per quarter

Missed or late super payments are not tax deductible. This could be an expensive error to make as an employer!

If you fail to meet your superannuation obligations on time, you are likely to get a prompt call from the ATO. In this instance, even greater penalties may apply – up to 200%. All employer’s specific circumstances will be different.

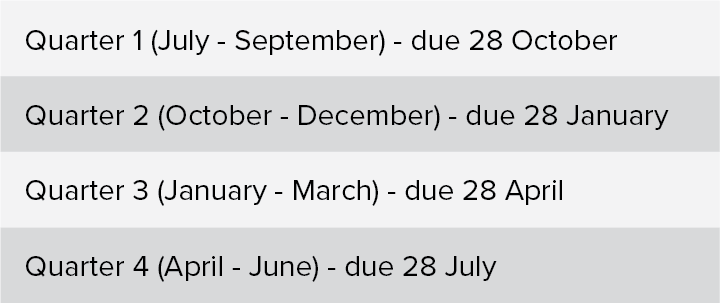

For your assistance, here’s a reminder of the annual SG contribution due dates:

As an employer, it is vital to stay on top of these superannuation employee obligations. For more information check out the ATO’s website here.

OR

Chat with your Highview specialist – we’re here to help! Contact us here.