Did you know, FBT-exempt cars are coming!?

Let’s look at a surprisingly little-discussed election policy that will likely change the landscape of employer-provided cars.

Tax policies?

The 2022 election featured an almost complete absence of tax policies. Almost. That’s perhaps not surprising, given what happened at the 2019 election. But that was then, this is now. And so, what tax policies did Labor propose? There were essentially three:

- Supporting the OECD’s Two-Pillar Solution for a global 15% minimum corporate tax

- Limiting debt-related deductions by multinationals at 30% of profits

- Fringe Benefits Tax (FBT) exemption from 1 July 2022 for certain electric cars – called the “Electric car discount”

It’s this last one that compels our attention. It’s interesting that this policy received almost no attention during the election campaign – we’re talking FBT-exempt cars! And yet, it will likely impact decisions by employers and employees alike.

FBT-exempt electric cars

The exemption from FBT will apply only to electric cars costing less than the luxury car tax threshold for fuel-efficient vehicles, which is $84,916 from 1 July 2022. Currently, there is only a handful of electric cars costing less than $85,000, but one expects economies of scale will bring down prices as they form a greater share of the market.

Details are not yet known, such as whether the exemption will extend to hybrid cars, or electric motor bikes. We’ll know when we see the legislation. To view the ATO’s current information on this click here.

Incentive to switch

When it comes time to update (or provide a car to an employee for the first time), both employees and employers will have an incentive to opt for an electric car over a petrol one.

For employers, where one or more cars are provided whereby any FBT is the employer’s cost, the benefit of switching to eligible electric cars is obvious – no more FBT cost.

For employees with a car provided as part of a set remuneration package figure, the change provides no direct incentive for the employer. Rather, it is the employee who is motivated to request an electric car. Whatever the components of the package (salary, superannuation, benefits, FBT, etc.), they must total to the set remuneration package figure. So, with FBT dropping out of the equation, what fills the void? You guessed it – additional salary and super.

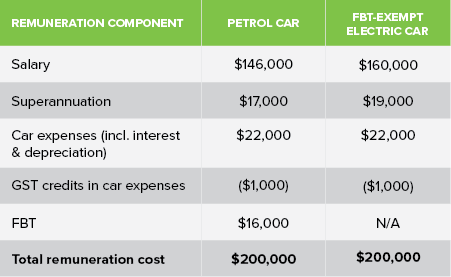

Here’s an illustrative comparison of a $200,000 remuneration package that includes providing an $80,000 car (figures are approximates):

In both cases, the employer’s total cost is the same agreed package figure of $200,000. Yet, with an FBT-exempt electric car, the $16,000 FBT cost is replaced with approximately $14,000 additional salary and $2,000 additional superannuation. So, the employee has about an extra $8,500 in their pocket (extra $14,000 salary, less 39 cents tax and Medicare levy) plus a bit more superannuation.

Overseas experience

Inspiration was no doubt drawn from the UK’s experience where a similar policy was enacted, after which electric cars went from 2% of the car market to 17%. The change won’t be legislated in time for 1 July 2022, but there is every reason to think it will be in due course.

Decisions

Employers managing their business’s use of cars, and employees with a car provided as part of their remuneration package, will have a clear financial incentive to switch to electric cars. Details will follow in due course when the legislation is released, so watch this space.

Talk to your trusted Highview advisor about how we can help you with making these decisions in your business. We’re here to help.

Sources:

Nexia Australia Consulting Specialists

Australian Taxation Office