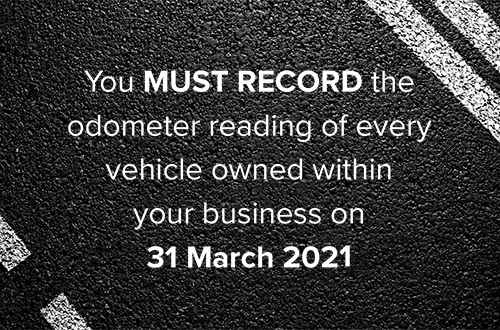

ATTENTION: Businesses that own vehicles – FBT Deadline

IMPORTANT REMINDER: You MUST RECORD the odometer reading of every vehicle owned within your business this Wednesday 31 March 2021 (this is the last day of FBT year). Please provide this information to your Highview Accountant.

What is Fringe Benefits Tax (FBT)?

Where a benefit is provided by an employer to its employees (or associates for the employee), FBT needs to be calculated and paid by the employer. The benefit may be in addition to, or part of, their salary or wages package.

If you are a director of a company or a beneficiary of a trust working in the business, benefits you receive in connection with your employment may be subject to FBT.

FBT is separate to income tax and is calculated on the taxable value of the fringe benefits provided.

The FBT year runs from 1 April to 31 March.

A prime example of a benefit is a motor vehicle owned within a company or trust, which your employee or yourselves have use of. Other examples of a benefit include entertainment, expense payments etc. This video provides a quick easy guide to understanding FBT: https://www.youtube.com/watch?v=t3DfgSIpsHc

If you have further queries in relation to FBT, please address these to your Highview Accountant or visit the ATO website for further details: https://www.ato.gov.au/General/Fringe-benefits-tax-(FBT)/Types-of-fringe-benefits/

Cranbourne: 03 5990 1000

Prahran: 03 9529 1566

Mornington: 03 5911 2100

Ringwood: 03 8899 9797