GST and the Sale of Residential Premises

The ATO are cracking down on the sale of ‘new’ residential premises. One of the main determinates is the intention of the original purchase – either for investment or development. This must be consistent from when purchasing the property and declaring intention with conveyancer, to claiming GST on construction costs and the contract of sale of the property.

Profit Intention – If you buy property – old or new – with the intention of selling it at a profit or developing it to sell, you may be considered to be carrying on a business and may be required to register for GST.

Investment Intention – Generally, selling or renting existing residential premises are input-taxed sales and do not include GST. However, if the residential premise is considered ‘new’, it is a taxable sale and GST is applicable.

The ATO recently concluded that where residential premises are used by a taxpayer for a ‘dual purpose’ prior to being sold (rented out and then sold), the premises may be considered ‘new’ and a taxable supply if the 5 year exception does not apply.

Whilst the supply (rent) of residential premises is usually input taxed, the sale or long term lease of new residential property is generally a taxable supply under S.40-65(2)(b).

A residential premise is considered ‘new’ if (subject to exception of 5 year rule) they have:

- Not been previously sold as residential premises

- Been created through substantial renovations

- Been built to replace or demolish premises on the same land

EXCEPTION – 5 Year Rule

As an exception, residential premises will not be ‘new’ if they have only been used for making input taxed supplies by way of rent for 5 or more years since:

- The premises first became residential premises

- The premises were last substantially renovated or

- The premises were last built

The 5 year rule must be continuous and starts from the time a property is, or is intended to be and is capable of being occupied.

Where the above requirements are met, the sale of such property will be an input taxed supply of residential premises, and, therefore, will not be subject to GST.

New Legislation – Purchaser to remit GST to ATO

From 1 July 2018, the Government will strengthen compliance with the GST law by requiring purchasers of newly constructed residential properties or new subdivisions to remit the GST directly to the Australian Taxation Office (ATO) as part of settlement.

Under the current law (where the GST is included in the purchase price and the developer remits the GST to the ATO), some developers are failing to remit the GST to the ATO despite having claimed GST credits on their construction costs. As most purchasers use conveyancing services to complete their purchase, they should experience minimal impact from these changes.

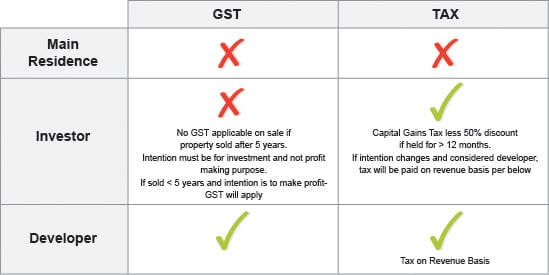

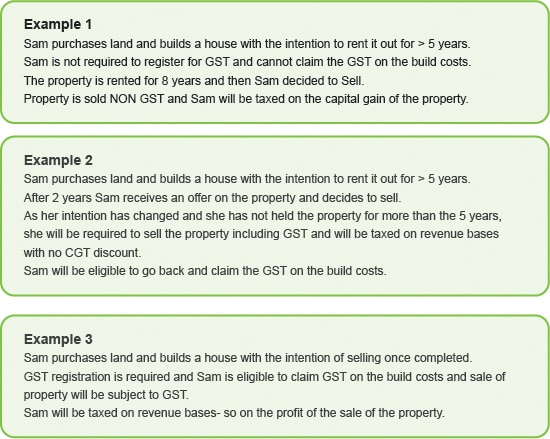

View the simple breakdown below, and read the examples provided. Should you have further queries regarding these regulations please do not hesitate to contact your Highview Accountant.

Article written by Highview CPA Samantha Young.