Rental properties – know your borrowing expenses.

What are borrowing expenses?

These are expenses directly incurred in taking out a loan for the purchase of your rental property.

They include:

- loan establishment fees

- lender’s mortgage insurance (insurance taken out by the lender and billed to you)

- stamp duty charged on the mortgage

- title search fees charged by your lender

- costs for preparing and filing mortgage documents (including solicitors’ fees)

- mortgage broker fees

- fees for a valuation required for a loan approval.

What is not included in borrowing expenses?

Borrowing expenses don’t include:

- the amount you borrow for the property

- loan balances for the property

- interest expenses (these are claimed separately)

- repayments of principal against the loan balance

- stamp duty charged by your state/territory government on the transfer (purchase) of the property title (this is a capital expense)

- legal expenses, including solicitors’ and conveyancers’ fees for the purchase of the property (this is a capital expense)

- stamp duty you incur when you acquire a leasehold interest in a property, such as an Australian Capital Territory 99-year crown lease (you may be able to claim this as a lease document expense)

- insurance premiums where, under the policy, your loan will be paid out in the event that you die, become disabled or unemployed (this is a private expense)

- borrowing expenses on any portion of the loan you use for private purposes (for example, money you use to buy a car).

Preparing your return

Rental property owners should remember three simple steps when preparing their return:

- Include all the income you receive

This includes income from short term rental arrangements (for example, a holiday home), sharing part of your home, and other rental-related income such as insurance payouts and rental bond money you retain.

- Get your expenses right

Eligibility – Claim only for expenses incurred for the period your property was rented or when you were actively trying to rent the property on commercial terms.

Timing – Some expenses must be claimed over a number of years.

Apportionment – Apportion your claim where your property was rented out for part of the year or only part of your property was rented out, where you used the property yourself or rented it below market rates. You must also apportion in line with your ownership interest.

- Keep records to prove it all

You should keep records of both income and expenses relating to your rental property, as well as purchase and sale records.

Claiming borrowing expenses

If your total borrowing expenses are more than $100, the deduction is spread over five years or the term of the loan, whichever is less.

If the total borrowing expenses are $100 or less, you can claim a full deduction in the income year they are incurred.

If you repay the loan early and in less than five years from the time you took it out, you can claim a deduction for the balance of the borrowing expenses in the final year of repayment.

If you obtained the loan part way through the income year, the deduction for the first year will be apportioned according to the number of days in the year you had the loan.

Example: apportionment of borrowing expenses

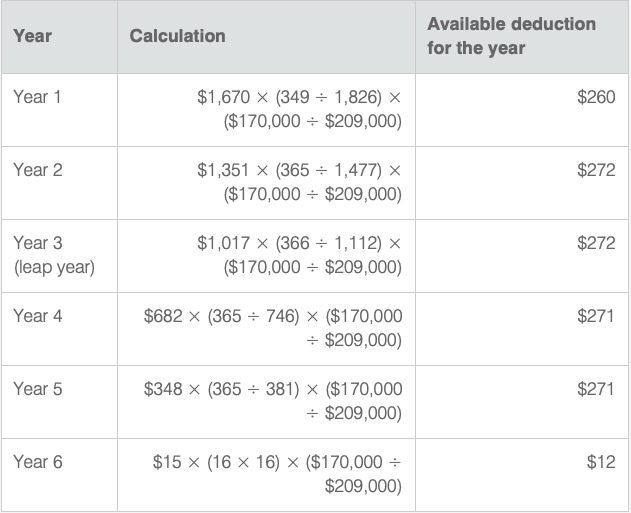

To secure a 20-year loan of $209,000 to purchase a rental property for $170,000 and a private motor vehicle for $39,000, the Hitchman’s paid a total of $1,670 in establishment fees, valuation fees and stamp duty on the loan.

As the Hitchman’s borrowing expenses are more than $100, they must be apportioned over five years, or the period of the loan, whichever is the lesser.

Also, because the loan was for both income-producing and personal purposes, only the income-producing portion of the borrowing expenses is deductible. As they obtained the loan on 17 July 2017, they would work out the borrowing expense deduction for the first year as follows:

REMEMBER – We’re here to help!

Highview have a team of specialists here to assist you with these claims come tax time, however, being educated on your expenses along the way is important to ensure there are no nasty surprises at the time you work with us on your taxation requirements. If you’d like to discuss these details further, touch base with your Highview specialist today!

Source: www.ato.gov.au