If your business is developing new products, improving systems, or experimenting with better ways to get things done, you could be eligible for the Research and Development Tax Incentive (R&DTI). This government initiative is designed to reward businesses investing in innovation—offering a tax offset (or even a cash refund) to help ease the cost of doing things differently.

Many businesses don’t realise the work they’re already doing could qualify. Whether you’re refining a production method, testing out new software, or finding smarter ways to deliver your services, R&D can show up in all kinds of industries. If you’re solving problems through trial and error or building something better from the ground up, it’s worth looking into.

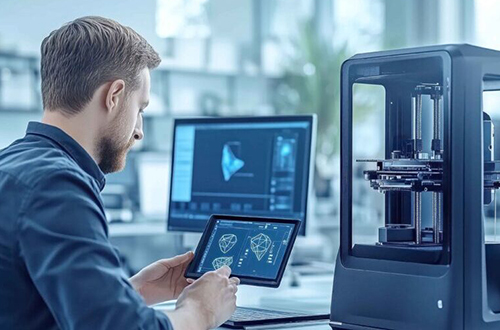

What Counts as R&D?

To be eligible, your activities need to involve a level of experimentation—where the outcome isn’t known in advance. Think testing, trialling, or prototyping with a structured approach. It’s not enough to just improve a product or process; it must be done in a way that aims to generate new knowledge or solve a technical uncertainty.

Expenses tied to these activities—like staff time, materials, and overheads—can often be claimed. And if your company has a turnover under $20 million, you might even be eligible for a refundable tax offset, meaning real dollars back in your account.

Not Sure If You Qualify?

You wouldn’t be alone—plenty of businesses are surprised to learn they already do R&D without realising it. That’s where we come in. At Highview, we’ve helped clients explore this opportunity and guide them through the process of assessing eligibility, documenting activities, and making a claim.

This isn’t just for the big businesses—small and medium businesses stand to gain the most. If you’re curious whether this could apply to your business, reach out to your Highview Accountant. We’d love to help.