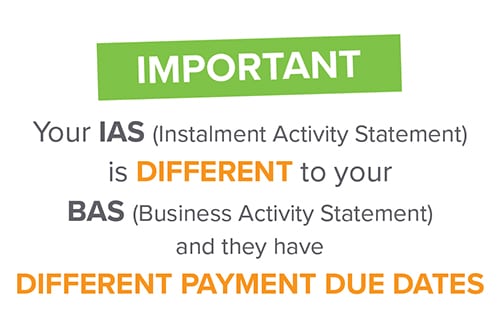

IMPORTANT- Your IAS & BAS are different!

An IAS is an instalment towards your following years tax – this could be for you as an individual or your business. This is a separate statement and DOES NOT have an extension option like the BAS. It is due 21 days after the end of the quarter (i.e. 21st of July, Oct, Jan, April).

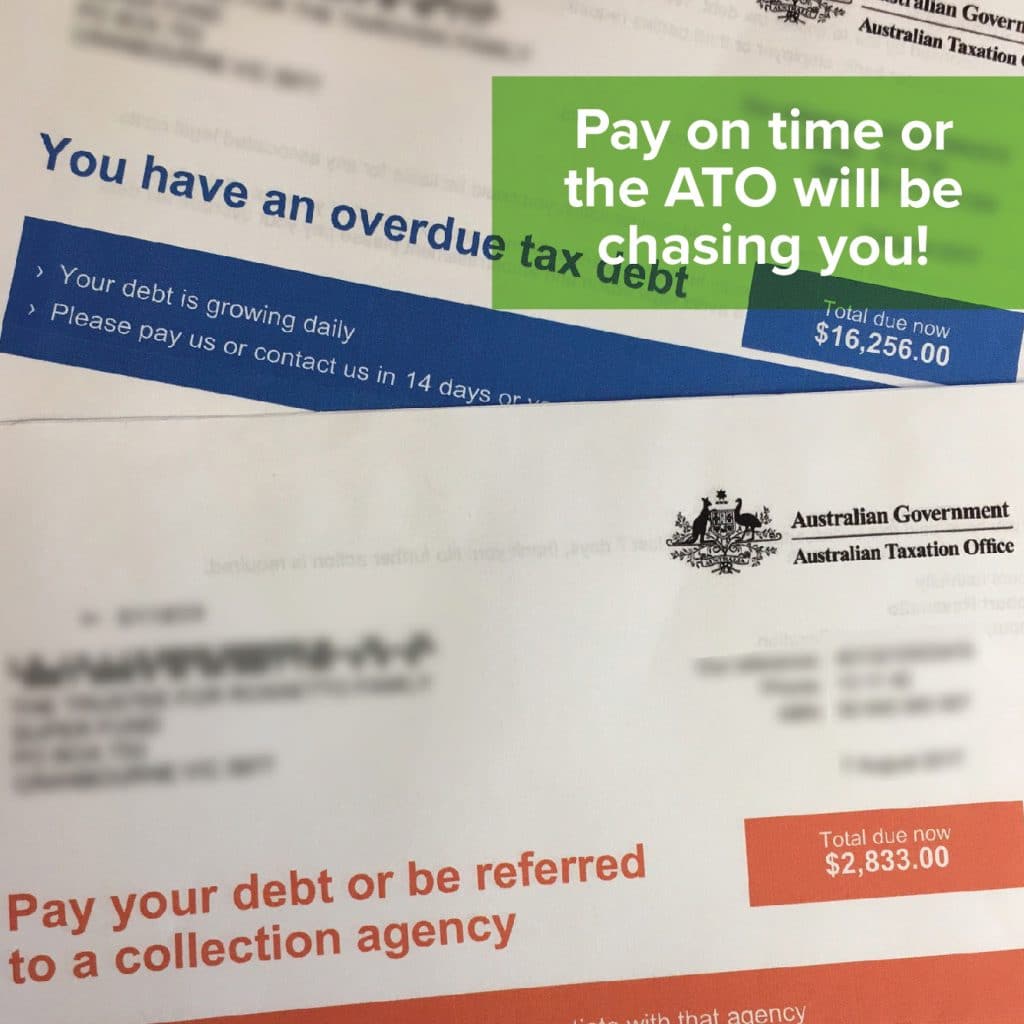

If you require your IAS to be varied, you must contact your Highview Client Services Manager prior to due date, otherwise the amount on the form will be payable and you may receive an overdue notice from the ATO.

A great way to ensure your IAS does not fall overdue is to get your BAS information to us prior to the IAS falling due.

If you have any queries or concerns please contact your Highview Accountant – we’re here to help.

Cranbourne: (03) 5990 1000

Prahran: (03) 9529 1566

Mornington: (03) 5911 210